It is not possible for the contractor to prepare a tender for every available project. Even in lean economic times, when jobs are scarce, some means must be employed by company management to decide whether to prepare a cost estimate and tender for a particular project. Some factors to consider are listed below (based on Clough and Sears (1994) and Pratt (1995)); items 1 through 12 relate to project characteristics, 13 through 16 to company status and its strategic positioning and 17 and 18 to external conditions.

1 Project type. Although some contractors claim to provide all kinds of construction services, in fact most specialise in certain types in which they have been successful. A builder of highrise buildings is unlikely to be interested in tendering on a remote oil pipeline.

2 Project size. Project size may be measured by a rough estimate of contract value or by some physical measure such as floor area or volume of concrete. The project under consideration may be too large or too small to be of interest.

3 The estimated cost of preparing the tender. Large projects can cost a contractor several million US$ for this effort.

4 Project location. Some contractors specialise in projects in remote regions, such as rural Alaska or mining districts of South America, while others confine their work to their home cities and surrounding regions.

5 Specialised work. Even within project types, there may be specialties for which the contractor lacks expertise. A concrete building contractor might decline to tender on a project with especially complicated or innovative formwork or another might avoid a project requiring specialised heavy lifting equipment.

6 Construction contract document quality. Poorly prepared contract documents may be the precursor of a difficult and conflict-prone construction effort, with design problems to be resolved as construction proceeds. Most contractors try to avoid such jobs, but some see them as opportunities to be exploited.

7 Contract terms related to contractor responsibility and liability. All contract terms are important, but those related to the potential degree of risk to be borne by the contractor are of special interest.

8 Design professional reputation. Distinct from Item 6 above, which relates to the documents for the particular project, some designers have reputations for fairness, timeliness, thoroughness and all the other characteristics that tend to make for satisfactory jobs. Others do not.

9 Owner reputation. Similar to Item 8, an owner with a reputation for slow payments, constant haggling over minute details and general surliness will have more difficulty attracting interested contractors than an owner with a supportive organisational culture. In addition, contractors appreciate owners with at least a minor degree of technical understanding as related to the project.

10 Anticipated construction problems. Many contractors choose not to tender on projects in which soil conditions, water problems, environmental contamination, complex coordination of subcontractors and other parties, extremely tight time schedules or even severely negative public reaction may lead to costly conflicts and delays. Judgment about this concern is related to Item 6, construction document quality and Items 8 and 9, design professional and owner reputations. As in Item 6, however, some tenderers view anticipated construction problems as challenges to be met and overcome, rather than avoided, with a potential lucrative outcome.

11 Safety considerations. Projects that appear to involve abnormally high safety risks, such as those in swiftly flowing streams, high vehicular or air traffic areas or high-rise buildings or those located near operating machinery or high voltage power lines, may not attract great contractor interest, especially from those with poor safety records.

12 Completion date. This consideration relates to the coordination within the company of all its projects and the deployment of personnel, equipment and other resources. But even if this is the companys only project, an unreasonably tight deadline would decrease the projects attraction.

13 Amount of other work currently underway. The degree to which the contractor needs the work is always a consideration. It is important to maintain a reasonably steady level of company activity, both from the standpoint of those performing field work and those preparing tenders. At a time of high activity, the contractor will be less interested in new work, but the real challenge is to predict the impact of this project on company activity in the months and years ahead, if the company is selected.

14 Bonding capacity. Those who provide surety bonds on behalf of contractors set limits on the total value of projects they will cover at any one time, based primarily on the contractors financial capabilities. If the project requires the contractor to furnish surety bonds, its estimated cost might exceed the limit, if it were to be awarded to the company, thus preventing the contractor from submitting a tender.

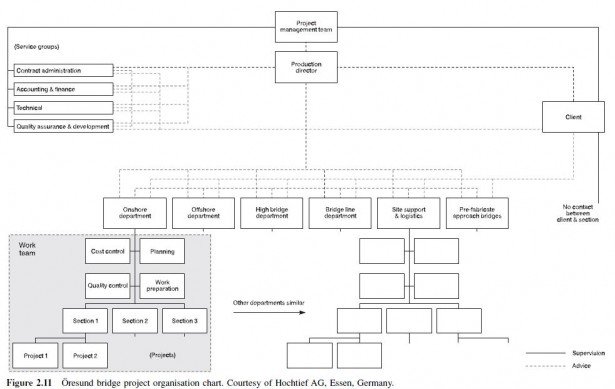

15 Potential for becoming involved in prestigious projects that might enhance the contractors reputation, such as the Euro Tunnel or the Trans Alaska Pipeline.

16 The opportunity that the project might provide for working into new markets, even though the financial reward for this project might not be great.

17 Probable competition. If 20 tenderers are expected, each has a 5% chance of success (other things being equal!). In such a case, the contractor may choose to spend its efforts on preparing proposals for projects with a smaller field of competition.

18 Labour conditions and supply. The contractor will want to consider whether required qualified labour is available in sufficient quantity. Also, potential difficulties in working with the local labour market and its collective bargaining agreements may weigh against submitting a tender.